- 15 January, 2025

This workshop, conducted for Balderton portfolio companies in September 2020, was an update to workshops previously run with the portfolio, and updated for the COVID era.

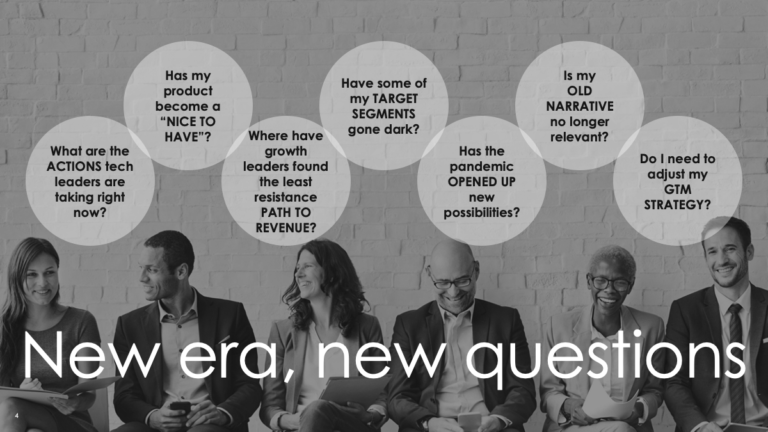

Right now, we are in the midst of a generational event. There is no going back. Workplaces and work habits have been thoroughly transformed. Entire industries have collapsed. Most companies are having to do sharp pivots. And now there are interesting new growth companies and industries emerging. All these changes are forcing technology leaders to ask questions about how they respond.

The team leading this workshop – Firebrick Consulting – has conducted positioning consulting for global leaders including Salesforce, Workday, Servicenow, Microsoft, VMWare, Riverbed, New Relic, GitLab and SuccessFactors, for example. The team led with the emphasis that these leaders have separated from the pack by telling powerful stories through positioning. And that positioning is a strategic priority, even more so now.

For tech companies that want to become category leaders, positioning is a core competency – positioning with stories.

The workshop leaders reminded us that executive buyers have now changed forever. So we cannot keep doing the same thing we always have been doing, and expect things to work.As technology companies selling to those buyers, we can no longer rest on the success of the past. There are new questions to answer: what should we be doing to adapt to this new environment, and what actions should we be taking to uncover new paths to revenue.

The good news is that every inflection point, and at every disruption point, new sets of category leaders have emerged.

THE SIX IMPERATIVES

This workshop highlighted six key imperatives for success, which were coalesced from the team’s analysis of which companies were successfully embracing this new disruptive period.

- Segmentation is “in” again

- Take a stand – have a viewpoint

- Focus on a business process that the pandemic has broken

- Your competition is you “doing nothing”

- Expand …then land

- Make your buyer the “new” hero

1. Segmentation is ‘in’ again

Downturns are always unforgiving. They require tech leaders to go deep to understand customers. Segmentation can be no longer done in a cursory manner. Positioning is all about laser-like focus. Focus sometimes forces difficult, but courageous, decisions, for example, to abandon certain buyers and embrace others that are more valuable.

In a downturn, consumers tend to be pragmatists and they tend to make conservative decisions. But they also reward companies who understand their problems, and seek to solve them.

Segmentation is about understanding what is driving a customer’s behavior. The vertical market segment is only one. It’s not enough. Think about segmentation in at least six or seven different ways.

Look for where issues that impact the customer segmentation might appear. Is compliance important? Is a client’s growth and an issue in onboarding talent fast enough a problem? Is business complexity a problem where a client is looking for specialized resources that are hard to find?

Market Segmentation Criteria

The rule of thumb: if you haven’t got six, seven or eight criteria that define a buyer, you haven’t gone deep enough. The better you know your buyer, the better your positioning story will be.

2. Take a stand. Have a viewpoint.

Companies that separate from the pack take a stand, and take a viewpoint. The status quo won’t save you in today’s climate. Tech leaders must work to avoid hunkering down and not changing.

Executive buyers are looking for leadership. Successful leaders have a strong viewpoint related to the customer problem they’re solving. Don’t bury buyers in the same old ‘tech speak.’ Shift your narrative to a strategic story that matters and identifies your solution to a known and understood problem. If you can, give your problem a name. Shift the discussion from features and functions in the product, to a discussion about a business problem you solve. Connect the problem back to your company’s clear differentiators.

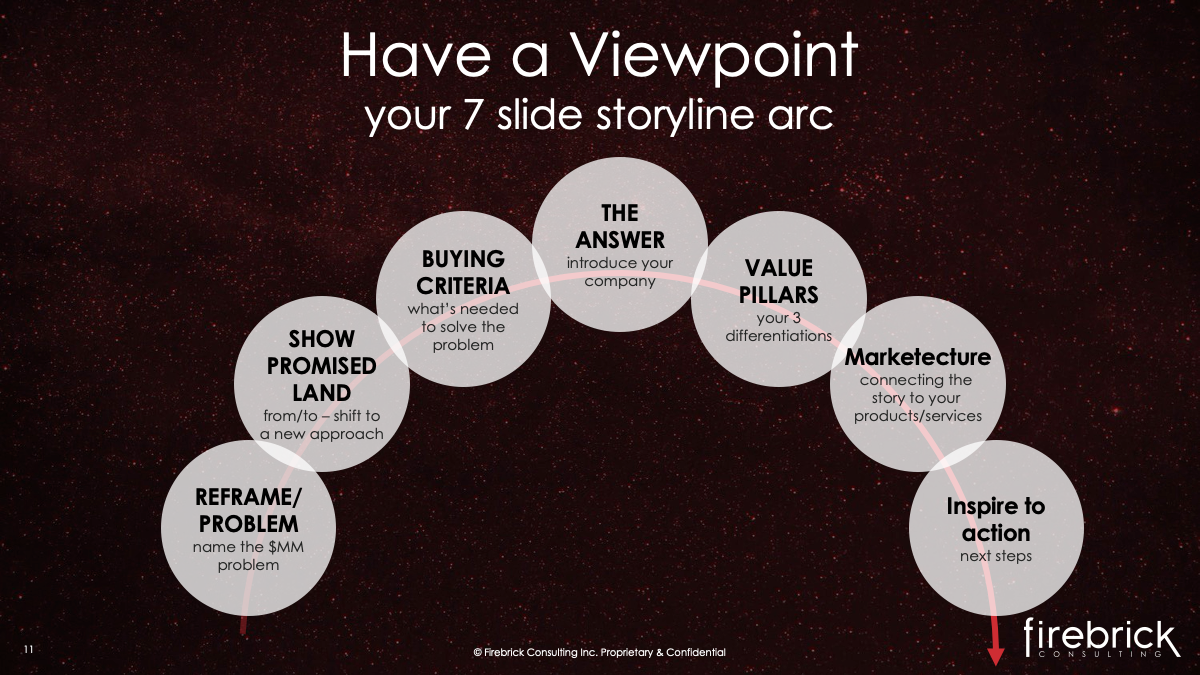

What does a strong viewpoint look like?

- Name the problem — reframe and name it as a multi-million dollar problem

- Show the promised land – move the buyer from here to there

- Define the buying criteria

- Reveal your answer (your product)

- Define your three pillars to show your differentiation

- Explain architecture (marketecture) that connects your story to your products

- Show how you’ll inspire to next steps and actions

Be singular. Consistent. Concise. Don’t have too many confusing messages. Bubble up differentiators into three distinct pillars.

Case study: a client in the healthcare supply chain business: when Covid hit, the narrative shifted and the team built a case that rather than the supply chain being a commodity, it was instead strategic – it was about a clinically integrated supply chain, supply chain resiliency, and value-based outcomes. This company used dynamics in the market to reframe their importance to their buyers.

Case study: a client that does integrity management on gas pipelines, using sophisticated risk modelling. But Covid slowed everything down. The issue just wasn’t critical. Instead, the narrative was reframed by showing that managing risks not just on pipelines, but across the enterprise as a whole, was business-critical.

3. Fix a business process

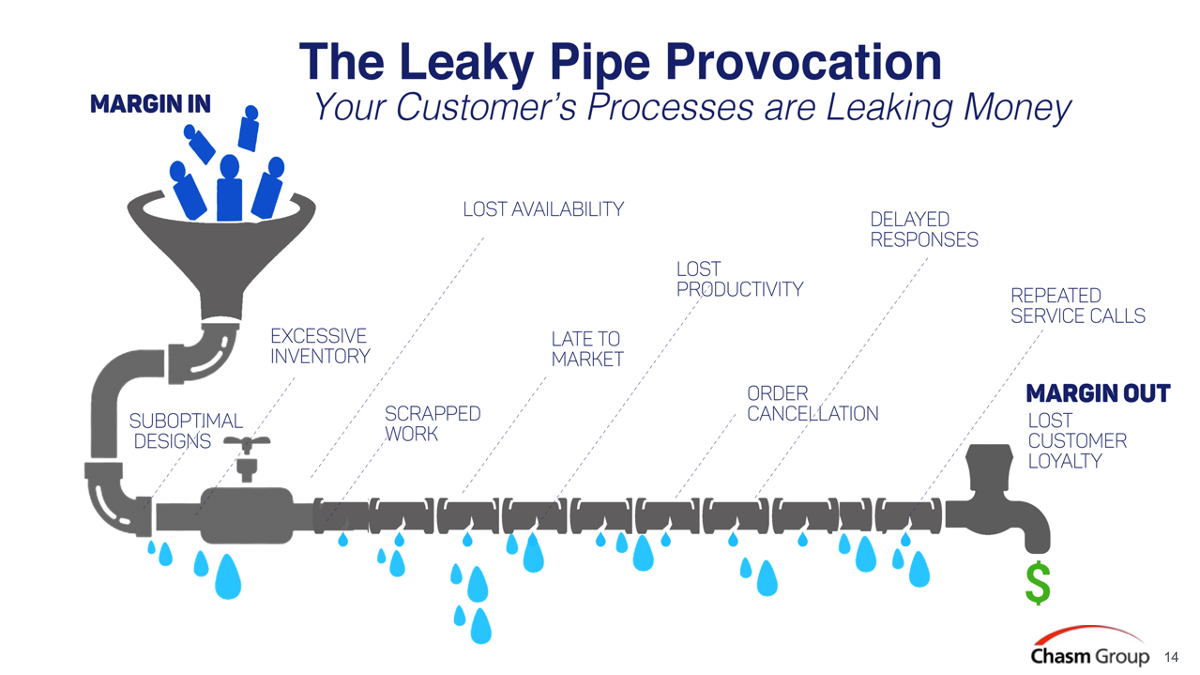

– particularly one that the pandemic has brokenThink about this like a leaky pipe. Where is the biggest leak? How do you impact plugging that leak? What is the big multi-million dollar problem (leak) that you can own, name, set the buying criteria for and fix? Pragmatists fix leaks, particularly in a downturn. This could be a process that was broken before, but the pandemic exacerbated the problem.

Case study: Market research got broken by Covid. A client put together a new form of tracking behaviour of customers now working from home and tracking their buying habits to those stay at home people, giving resulting buying habit data to companies like Unilever.

Case study: a client focused on digital media spend performance. Digital media spend performance data is supposed to be reliable – after all, it’s data-driven. But it’s not. There’s a confidence gap. You can’t always rely on the data. This client took a view that they could give you confidence and fill that confidence gap. They named the problem – the confidence gap – and explained to their buyers how their product can give them the confidence to know the data is going to accurately help them spend wisely with maximum ROI.

4. Your biggest competitor is “doing nothing”

Don’t stick to the status quo. Help your buyers build a case for how your product is relevant to them now, and why they should be rocking the boat. To do this, you have to own a really big problem. (Particularly a problem that if the buyer doesn’t solve it they’ll lose their job!)No executive buyer really wants another tech vendor.

You have to deliver a really provocative informed response. Give them a reason they should make a bet on you, rather than just keeping their heads down. You need a compelling storyline for your relevance and inject a sense of urgency.

Case study: customer experience business client. However, with Covid survey results became a ‘nice to have’ not a must-have. So this client reframed the issue to be one of customer experience – this market feedback is the critical feedback to understand how customers are responding and showed how their product delivered the currency for understanding consumers.

5. Prioritize expansion before landing

In a downturn, customers are retrenching. Hunting for new logos becomes harder. So consider focusing on existing customers is a worthwhile approach (even though a focus on existing customers is always important). Rather than just focusing on bringing in new logos, look at the customer experience and customer success of existing clients. Is that function fully resourced? Are you best people working on it, or just under-resourced junior people?

There are multiple dimensions to expanding an existing customer: new divisions, new users, new usage, new functionality, new geographies, new use cases; Take these dimensions on strategically.

6. Make your buyer the new hero

Can you make your target buyer the new hero, and navigate the next normal and all the market uncertainties? Give your executive buyer a new strategy to navigate this period.

Case study: moving an organization that manages field workers’ field schedules and tasks, to a strategy where this organization becomes the field engagement strategy- the frontline ambassadors. The positioning exercise gave them a new strategy for thinking about growth.