- 15 January, 2025

In this article, we take a look at 94 European and US venture-backed companies worth over a billion dollars to see where, and when, they expanded internationally.

How we researched the numbers

We looked at the 47 $1B+ European tech companies to see when and where they opened physical offices around the world. We then compared this to 47 of their US counterparts. Obviously, many companies build international business without opening new offices, but we used physical offices as a proxy for meaningful international growth.

How quickly European companies expand internationally

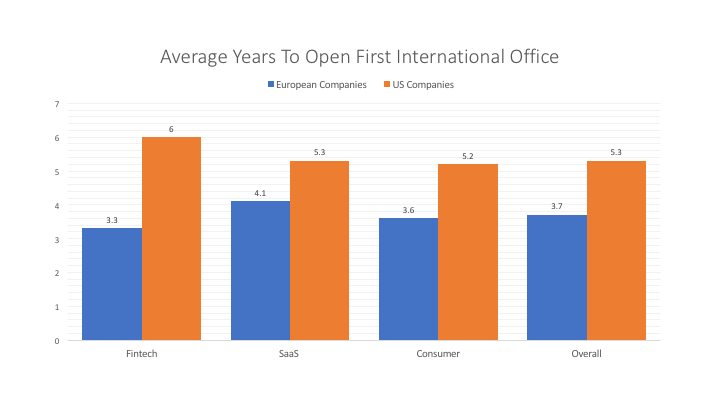

We found that European companies expand internationally 19 months faster than their American counterparts.

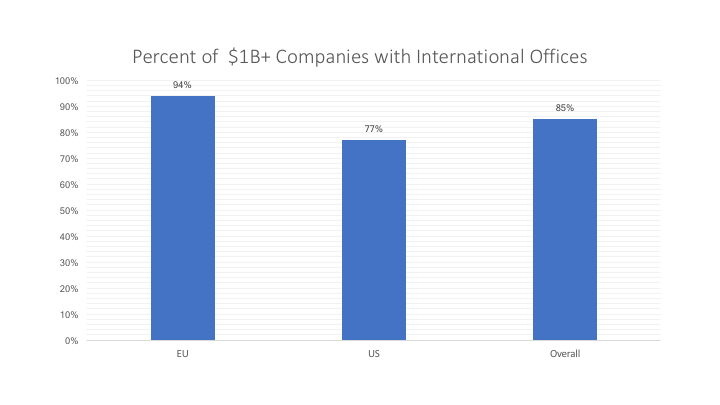

Our research showed that 94% of European $1B+ companies have opened international offices, compared to 77% of the US companies. The European companies opened their first international office in an average of 3.7 years, compared to 5.3 years for American companies. This is out of necessity; very few companies European companies can reach $1B+ within their own countries, and therefore are quicker to move to new markets (Zoopla being the most notable exception).

European companies expand internationally 19 months faster than their American counterparts.

% of $1bn+ technology companies with International offices

Number of years to open a first International office – in all sectors, European-born companies open their first International office sooner than companies in the United States.

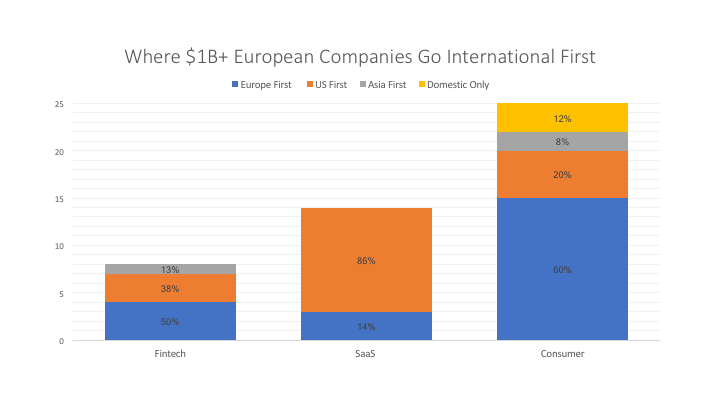

Where $1bn+ European-born technology companies go first.

Where European technology companies expand first

86% of European SaaS companies open their first international operations in the US.

Nowhere is US expansion more important than with enterprise software, which is why we see 86% of $1B+ European SaaS companies open their first international office in the US.

Getting traction with American companies as early as possible is the best way for European SaaS companies to set themselves up for success. For example, Balderton portfolio company Aircall opened its New York headquarters just two years after launching in Paris. CEO Olivier Pailhes explains why. “We spent four months in the US at 500Startups, and we realized that the US is the biggest market, and the most demanding.

Putting a high priority on building a US position – and moving key cofounders there – really helped us to make sure we built our product against the best of breed competitors and the highest demanding customers”.

At Balderton, we push our founders to think globally and about the US from day one.

Too often, entrepreneurs who have a first mover advantage stay in the UK, then wait some time to go to France, and then start in Germany, and then Spain…etc. That sequential approach takes too long and by the time the company is ready to cross the Atlantic, a competitor in the US has popped up, raised $50m and gotten a head start. By then, the first mover advantage is gone, and the fight to win in the US is a much more uphill battle.

Bernard Liautaud, Managing Partner at Balderton and previous CEO of Business Object

Where US technology companies expand first

72% of the European consumer businesses expand within Europe first. However, most consumer-focused businesses decide to open their first international offices in neighbouring European companies or stay domestic rather than go to the US first.

When you take the total addressable market of Europe, it ends up being greater than the US. Combine this with more confidence in your product market fit due to cultural and geographical similarities and decreased operating risk, Europe becomes the easy choice to tackle first.

Isabel Bescos, Balderton investor and previous Head of Strategy at BlaBlaCar

While the US is an extremely important market and most successful companies open offices there eventually, as a consumer business, it is possible to build a $1B+ company without heading there. In fact, 23% of these European giants have done so, reaching just European consumers, or deciding to move to the Middle East or Asia instead of facing American competition head-on.

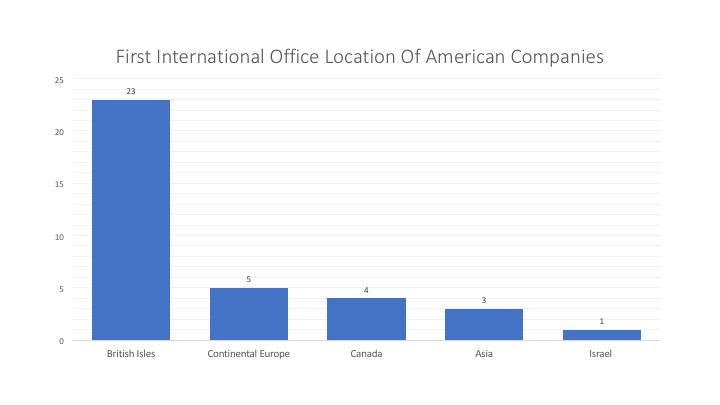

Europe is the primary destination for US tech giants.

The European market is still crucial for building global software businesses. 78% of international US companies open their first international office in Europe. English-speaking locations remain the most popular first office destinations for American companies, with 64% of firms opening their first offices in London and Dublin.

While language plays a huge role, we’re curious to see if this trend continues to play out as Brexit looms. In the future, we also expect to see many more booming tech startups from both the US and Europe consider Asia as the first stop on their path to being global businesses.

Typical location of the first International office for US-founded technology companies

About the data

We looked at 94 venture-backed companies in the US and Europe founded since 2000. For the European companies, we looked at companies with $1B+ valuation (as of July 2018) founded in Europe (excluding Israel and Russia). We then looked at the highest-valued US companies founded since 2000 and took the top 47 by valuation to compare to the European cohort (knowing there are more than 47 in the US).

The full list of companies we looked at is here. If you have any corrections or additions, please let us know.

ROB MOFFAT

ROB MOFFAT