- Portfolio News

- 05 February, 2025

The funding was led by Balderton, and will be used to incentivise investment in real climate impact and fuel US expansion.

Much of the world recognises the importance of meeting net zero by 2050, but nearly all companies with net zero targets will fail to achieve their goals if they don’t at least double the pace of emissions reduction by 2030. It will take an estimated capital investment of $3.5 trillion annually over the next 30 years, from both the public and private sectors, into the technology and infrastructure required to deliver a zero-carbon economy. This will need to include both decarbonisation efforts and investments in carbon credits to account for emissions that currently cannot be eliminated in full. At the moment, the pace of action and investment lags far behind what is required, and a lack of data has made it nearly impossible to measure and benchmark progress against net zero targets and the effectiveness of climate action investments.

Purchasing carbon credits, which fund projects around the world like protecting rainforests from deforestation or providing clean cooking stoves, is one of the most established and scalable ways to channel finance to effective climate outcomes. But, investors need robust, unconflicted information and accurate impact assessment of these carbon credits.

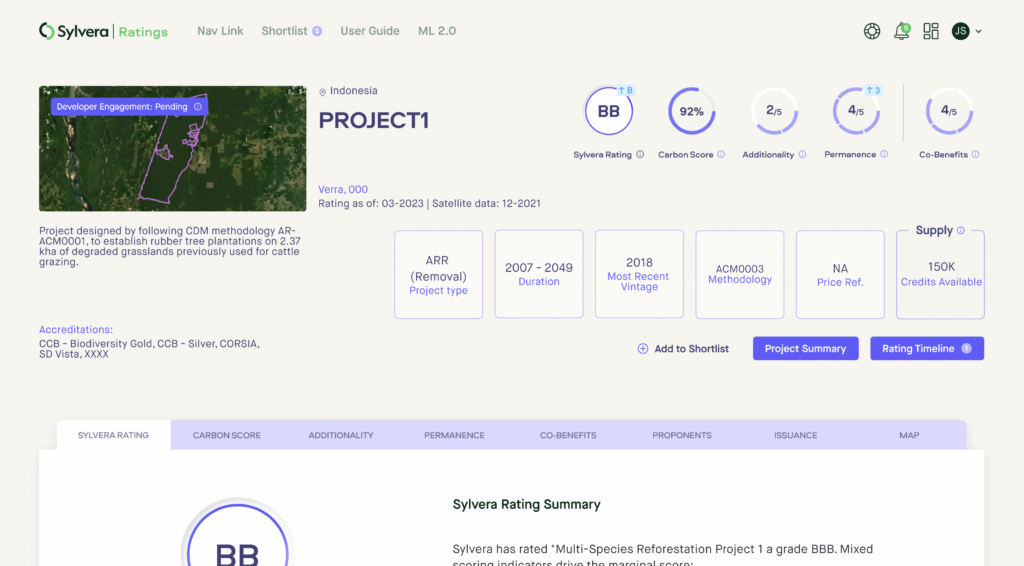

Founded in 2020 in the UK, Sylvera makes it possible for companies and governments to invest in carbon credits and confidently report on their impact. Combining cutting-edge technology with leading carbon measurement methodologies, Sylvera provides ratings and data assessing climate action investments, including carbon credits, allowing organisations to confidently deliver their net zero strategies and work towards societal net zero.

There is a serious lack of data to demonstrate progress against net zero targets and to prove that carbon emissions are actually being reduced or removed from the atmosphere. This uncertainty has created inaction–Sylvera is changing that. Our technology ensures funding is going to the projects, companies, and countries having maximum climate impact to get the world on track for net zero. In time, this data will create much-needed financial incentives, such as higher share prices and cheaper borrowing, for organisations taking serious net zero action.

Allister Furey CEO and co-founder, Sylvera

To help organisations ensure they’re making the most effective investments, Sylvera builds software that independently and accurately automates the evaluation of carbon projects that capture, remove, or avoid emissions. Sylvera develops and tests rigorous, holistic methodologies to rate projects and produce data, leveraging the latest technology and climate science.

Sylvera co-founders Sam Gill and Allister Furey

The new funding will enable Sylvera to further build its platform to include new data and information about carbon credits and how that sheds light on companies’ plans and genuine progress against their net zero targets. It will also support the company as it scales its technical capabilities and grows the engineering and product teams.

There is an urgent need to provide the most accurate and transparent views on the multitude of carbon projects around the world in order for corporations, governments and markets to trust in the carbon credits they are buying and effectively scale their climate contributions and head towards net zero. Sylvera has proven to be the market leader in this emerging field and we are excited to be joining them on the next phase of the journey and their work in accelerating the roll-out of data, tools and software in order to steer a path to reducing damaging climate change.

Daniel Waterhouse Partner, Balderton

This news comes as Sylvera expands to the US and opens a local office in New York. A global hub for financial markets, a presence in New York will allow Sylvera to entrench into the financial services infrastructure and grow its industry relationships. Currently, the company has twelve US employees with plans to double the team by year-end.

Since January 2022 the company saw sevenfold growth in its customer base, forging partnerships with firms including S&P Global, and bringing on clients ranging from major financial services institutions to sovereign governments. Recently, the company added a Chief Technical Officer to its leadership team, Serge Kruppa, who led engineering functions within strategic business units at Checkout.com and Twilio.