- Portfolio News

- 25 April, 2025

The fundraise was led by ICONIQ Growth, with participation from existing investors including Accel, Balderton, Seedcamp, Speedinvest, and RTP Global.

Primer, which was founded in early 2020 by ex-Paypal/Braintree employees and now employs more than 70 people across 20 countries, has built the world’s first automation platform for payments.

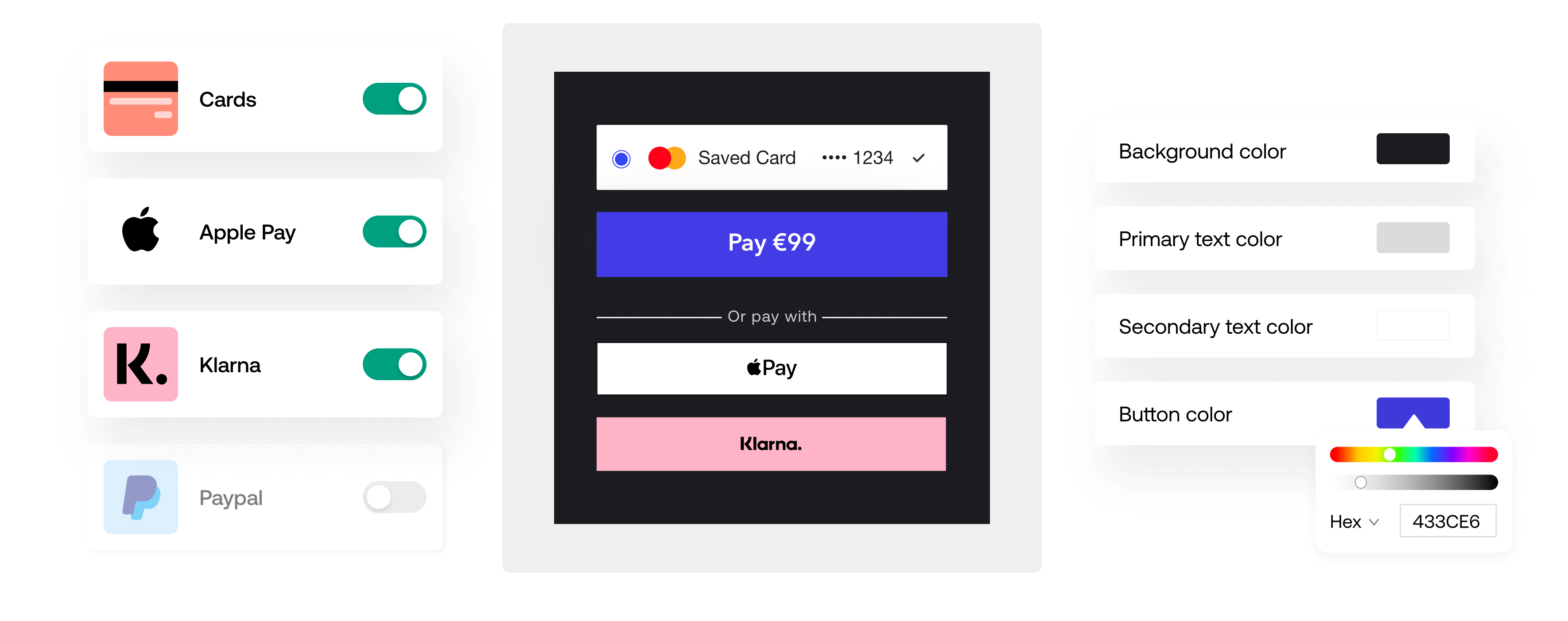

Balderton first led Primer’s Seed round in 2020. With Primer, merchants can build new and better buying experiences with ease. Plug-in any desired payment solution with 1-click connections, define logic across the entire payment lifecycle with a drag-and-drop workflow editor, and create seamless, “smart” checkout experiences that meet today’s customer expectations. For the first time, merchants can connect and control their entire payments stack, and build their ideal payment flows autonomously from scratch.

Our past experience running hundreds of deep-dive technical workshops with some of the biggest online companies like Uber, Spotify and Airbnb, has given us unique insight into the deeply-rooted technical fragmentation that exists in global payments.

Paul Anthony Co-founder, Primer

Primer offers all the underlying infrastructure for merchants to create new, better buying experiences for their customers. But, we’ve barely scratched the surface of how payments automation will disrupt payments for good. Our mission is to make payments a first-class product area in any business.

Paul Anthony Co-founder, Primer

Crucial to our business success is the ability to expand to new cities and countries seamlessly. Primer has allowed us to add several payment methods without building and maintaining multiple integrations, helping us optimise our checkout experience and expand fast to new markets.

Caroline Hjelm VP of Growth, Voi, (Balderton portfolio company and an early Primer customer)

Primer also creates a whole new, open distribution channel for services across the payments landscape to go-to-market. Any third-party developer can build connections to integrate new services, from payment methods and fraud tooling to data warehousing and customer messaging platforms.

Merchants simply ‘click and connect’ to the ever-growing list of services from within their Primer dashboard, requiring no additional code. Live connections include Checkout.com, Stripe and WorldPay as well as early adopters Klarna, Stitch Data and GoCardless.

The new funds will help Primer pave the way for rapid expansion across Europe, the US and Asia. Primer expects its fully remote team of more than 70 employees to triple in 2022.

With teams established and merchants live across Europe, Asia and North America, we’re primed to use this investment to expand our already global footprint. We have people deployed in 20 countries but need to grow our teams even more quickly to support the demand we’re seeing among both merchants and the third party services across multiple countries and sectors that want to work with us.