- Portfolio News

- 04 March, 2025

The Series G round was led by Permira’s Growth Opportunities fund and BlackRock Private Equity Partners and values GoCardless at $2.1 billion.

Balderton first invested in GoCardless back in 2013 and has continued to invest ever since, including in the most recent round.

The funding will allow GoCardless to accelerate its growing footprint in the open banking space through both product and geographical expansion as it targets becoming the world’s leading network for direct bank payments.

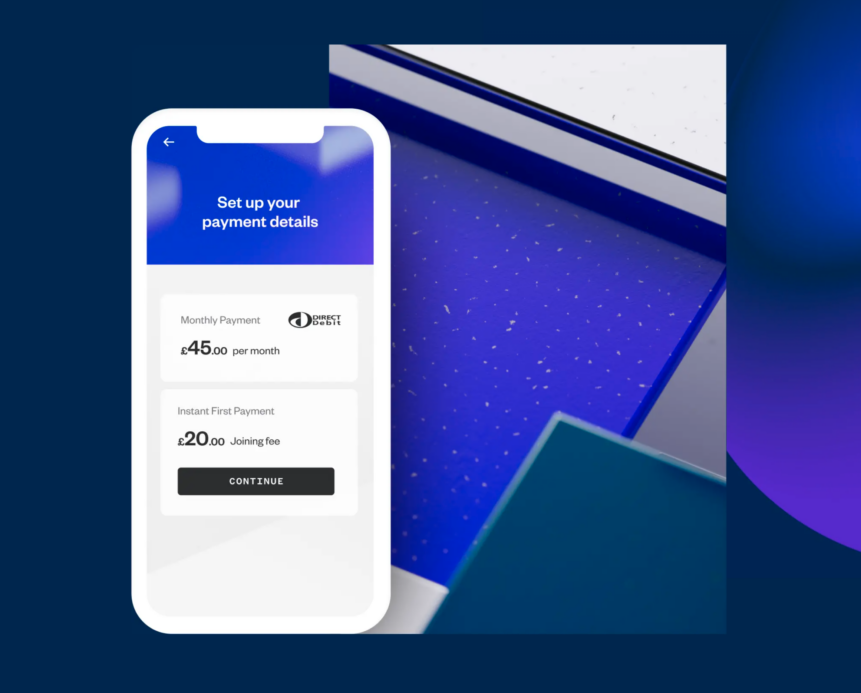

GoCardless processes more than $25bn in transactions per year and serves over 70,000 businesses around the world, including DocuSign, Klarna, TripAdvisor and Epson. Since its last funding round in December 2020, the company’s valuation has more than doubled, while headcount has grown by 85%. GoCardless accelerated its investment in open banking product development and launched Instant Bank Pay, a new way to collect one-off bank-to-bank payments using open banking.

The rise of open banking presents a once-in-a-generation shift, one that will change the way payments happen all over the world.

Hiroki Takeuchi, Co-founder and CEO, GoCardless

GoCardless CEO and co-founder, Hiroki Takeuchi, with Balderton Partner Suranga and other CEOs at the Balderton CEO Collective retreat.

When the pandemic first hit in 2020, millions of small businesses were forced to rely solely on their online payments, or even start taking recurring payments online for the first time. The GoCardless team, and their powerful payments infrastructure, stepped up at this critical time to help their 10,000s of businesses to continue to grow during these difficult two years, as they have throughout the life of the business.

James Wise Partner, Balderton

With the round, GoCardless will also add further technology and payments expertise to its Board of Directors with Michael Rouse, former Chief Commercial Officer at Klarna joining, and Koen Köppen, Chief Technology Officer at Klarna and Board Member of Mollie, joining as an independent director.

As GoCardless builds on its decade-long experience in direct bank payments, the company will broaden its focus to enable both recurring and one-time payments, and continue its international expansion. It will also open its ‘bank pay’ network to other payment service providers who want to tap into its technology and platform.

As well as an exceptional business, GoCardless has built one of the strongest cultures and alumni networks in European technology. It is huge credit to Hiroki, Matt and Tom that so many successful start-ups have also been founded by GoCardless alumni.