- Portfolio News

- 25 April, 2025

The round was led by EQT Ventures, with participation from existing investors including Balderton, LocalGlobe and SBI.

The new round was announced in TechCrunch today. Balderton previously led Cleo’s Series A.

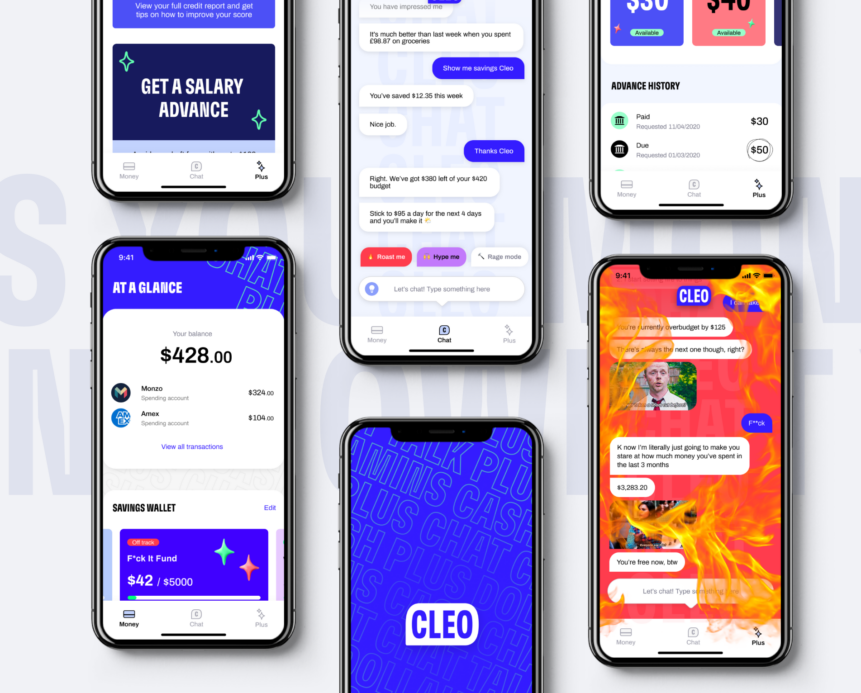

Cleo first found success in 2016 as a digital assistant which aimed to make managing money fun and approachable for a young generation.The company has since evolved into a trusted advisor for a generation by making a meaningful impact on user’s financial health.

We’re building Cleo to become the financial advisor that a billion people need. One that talks to you like a real person, able to build trust and relationships like a bank never could. The work we do at Cleo has never been more urgent. This crisis has been devastating to the generation we serve. They’re facing true financial hardship with no one to turn to.

Barney Hussey-Yeo CEO, Cleo

Cleo offers users insights into their financial life and helps them make strong financial decisions from day one.

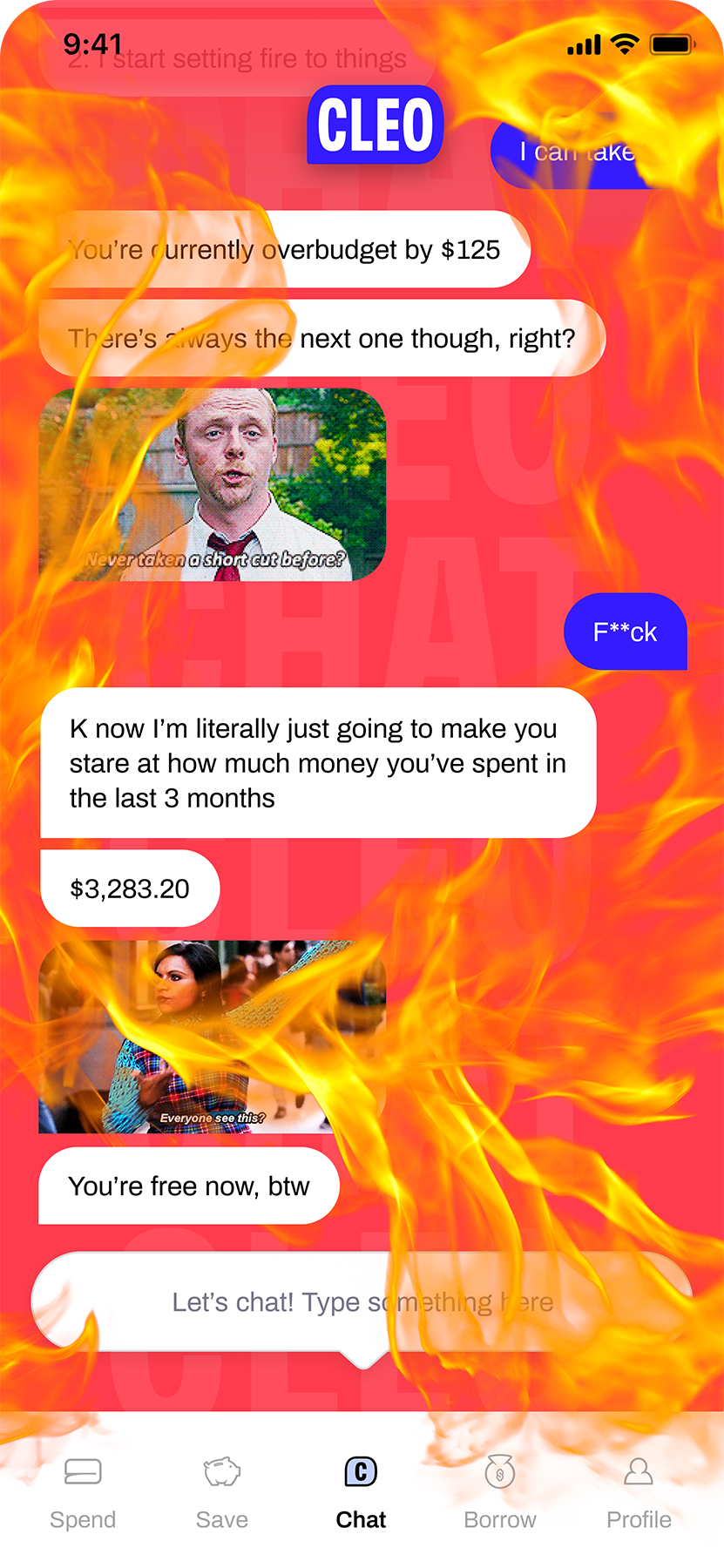

For example, Cleo can use AI to create personalised smart budgets for every customer, helping them to improve their budgeting skills.Users can simply ask Cleo ‘Can I afford it?’, and receive everything from spending breakdowns, to help on bills and practical financial advice, all delivered through a chatbot with an actual personality. Cleo even has different personality settings, including a “Roast Mode” where users can be rinsed for their spending habits.

Read more about the features and try out ‘Roast Mode’ here.

Now trusted by four million Gen-Z and Millennial users, 96 percent of which are US-based, Cleo has reached increasingly strong unit economics and over 400 percent revenue growth in the last year.

As Cleo continues to drive towards profitably, this latest round gives them the resources to double down on their mission. The new capital will provide the team with the resources to explore new ways to improve credit, build personalised spending plans to stabilise financial safety nets and stop the paycheck to paycheck cycle.

Cleo will further the US expansion as it continues to make leadership hires in the Bay Area. If you’re interested in joining their team – you can see their current opportunities here.