- Portfolio News

- 25 April, 2025

Why we raised Balderton Growth I

JUN 10, 2021

This year Balderton turns 21. In many cultures, this represents a coming of age and a chance to debut oneself.

Our partnership embraced this “growing up moment” and used it to undertake the most significant change to the firm since our spin-out from Benchmark. Today, we reinvent ourselves as a multi-stage venture firm, with the creation of our first fully-fledged growth fund.

Today, we reinvent ourselves as a multi-stage venture firm, with the creation of our first fully-fledged growth fund.

Bernard Liautaud, David Thévenon and Rana Yared will be leading investments on Balderton Growth I, supported by the full investment team.

A bright European future ahead

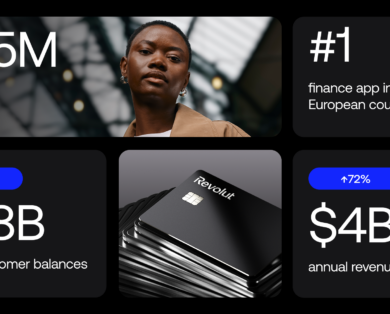

In many respects, our coming of age coincides with the coming of age of European technology entrepreneurship.At our inception in 2000, Bluetooth and the USB drive had just made their first appearance, and the iPhone was still seven years away. The technology investing ecosystem looked markedly different. Even in those early days, we had the good fortune to invest in early market leaders that would shape their respective industries, such as Betfair, Yoox / Net a Porter, MySQL, and LoveFilm.Following the financial crisis, the “quality exits” in Europe, defined as exits with greater than $250m of gain, totalled $6bn for 2008 / 2009.A decade later, the 2018 / 2019 cohort reached $67bn.Many will be surprised to know that in the intervening years, returns from venture-backed European firms have outperformed those from American companies on a 5 year and 10 year IRR basis. This has happened as investable opportunity has grown exponentially as well. In 2009-2011, total investments in rounds between $25-$125m were less than $5bn. We expect that figure to exceed $50bn in 2021-2023.

Roots and shoots

In our first two decades, we have had the good fortune to invest in and be in service of 230 leading entrepreneurs across Europe from cradle to exit. On occasion, we have wished to deepen and extend our support to our portfolio in later rounds. Equally, we experienced moments of great humility, where we collectively missed backing the next great European company or founder. But why raise a growth fund? Many inches have been filled commenting on venture financing being awash with money. Why stray from our roots as a leading Series A fund into early growth? Simply, from the strength of our roots, we grow new shoots.My partners have given our firm deep roots as investor-operators. Two-thirds of us came to investing having founded and IPOed multi-billion dollar businesses or having led significant organizations within the world’s leading technology firms as senior operators. Thanks to them, Balderton’s rootstock is working side by side with our founders and companies to tackle their most pressing problems, at every stage. Money is usually easy to find, (we often wish it were not!), but consistent, personal attention from investors, through all cycles and all stages stands out.

Money is usually easy to find, (we often wish it were not!), but consistent, personal attention from investors, through all cycles and all stages stands out.

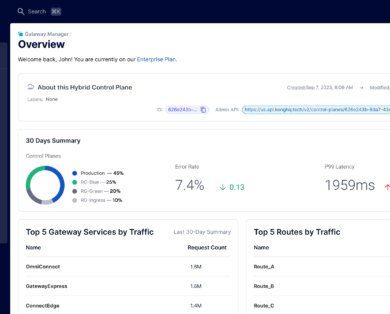

Further, we believe to serve our companies well, we must remain local – European. In this belief, our new shoots bloom. By virtue of our early stage portfolio growing up and now investing our ninth fund, Balderton already holds one of the largest growth stage portfolios in Europe. We have seen, first hand, the difference proximity, or lack thereof, makes for our founders and CEOs, particularly at the growth stage, where they grapple with wide ranging issues, from geographic expansion to going from product to platform, to capital markets planning, all at a breakneck pace. While there no longer exists a shortage of growth stage capital for European companies, local, European, proximate, and deeply experienced global growth investors remain in scarce supply. Both our portfolio companies and companies in whom we (regrettably!) failed to invest in consistently share this lamentation with us.Building on the success of our first mid-stage fund, Liquidity Fund I, our approach for the Growth Fund is “one of few.” This means personalized attention from the entire partnership, with access to Balderton’s European leading platform team (the first in Europe when we started it a decade ago), for a dozen or so leading companies with global potential. Our Liquidity Fund introduced an important capital solution to the European venture market – the first fund with a dedicated capability to engage in secondary share purchases. This helped forestall the premature exits we had seen and adds robustness to the exit valuations. We felt at the time and now, armed with the experience of having invested the Liquidity Fund, strongly know that we introduced an important innovation for the broader ecosystem. Yet another root from which we graft the strategy, our Growth Fund has the capacity to work with companies on both a primary and secondary basis.

What’s our talent?

In the American tradition, debutante balls frequently include a talent portion, a chance to demonstrate that some unique skill acquired to date. So what’s our talent? Our unique partnership and the relationships we have built over 20 years. Since our inception, Balderton has been an equal partnership. Every partner at the ready for every portfolio company and every investment carrying importance for every partner; every partner equally important to the firm. The firm having the longevity to go from strength to strength even as we undertook natural generational changes in our partnership.It is exactly thanks to our “one firm / one partnership” approach that we developed our second talent – maintaining relationships with the most talented founders across Europe, even when we had not invested in them. We had long hypothesized that these relationships were genuine; however, it was not until we started investing our Liquidity Fund that we put this theory to the test. The outcome far exceeded our expectations. Two-thirds of the companies in the portfolio came from outside the Balderton family, and one-third of the founders chose to only seek us out, citing the quality of the previous interactions. We are humbled by the confidence they placed in us and buoyed by the knowledge that when investing the growth fund we rely on the same depth and strength of relationships to deliver best in class returns to our investors.

Since our inception, Balderton has been an equal partnership. Every partner at the ready for every portfolio company; every investment carrying importance for every partner; every partner equally important to the firm.

The momentum in the ecosystem combined with our unique advantages convinced us, as a partnership, to launch our growth fund and debut as the new Balderton – a multi-stage venture firm ready to support Europe’s best and brightest companies in even more ways than we have historically. We have no shortage of gratitude for the partners of the firm, past and present, who grew the deep and strong roots on which we grow today, and our founders and investors who place their trust in us as we raised the fund.Here’s to 21! And to continuing to bloom and grow!

Rana Yared and David Thévenon