- 15 January, 2025

Balderton Partners, Rana Yared and Rob Moffat, explain why the sector is on the cusp of its next revolution.

The world of payments is changing rapidly. We believe we have reached a pivotal moment that will change the way we think about payments and result in many new players entering the ecosystem. Today, companies whose raison d’etre is far from fintech find themselves needing to process payments transactions in very large quantities; we refer to this phenomenon as the “fintechization of consumer businesses.” The historical infrastructure which only supported financial institutions with payments is therefore increasingly unfit for purpose. While open banking for payments is still in its infancy, we expect to see growth in adoption when the UK introduces Variable Recurring Payments (VRP) in July. At the same time, the broader adoption of digital assets and cryptocurrencies has highlighted how non-traditional technologies can be used for traditional payments.

Managing payment complexity

Change is particularly apparent when you look at the consumer side of the market. Merchants today have no choice but to think carefully about payments. Many of them are important access points into the payments workflow. We have seen our portfolio companies building teams of 10 people or more, just to manage all the different payment methods for relatively small businesses. Larger merchants have teams of hundreds managing reconciliation, payment flows, and failbacks. While this may seem unusual, online merchants often find that the underlying business they are running is functionally a fintech.

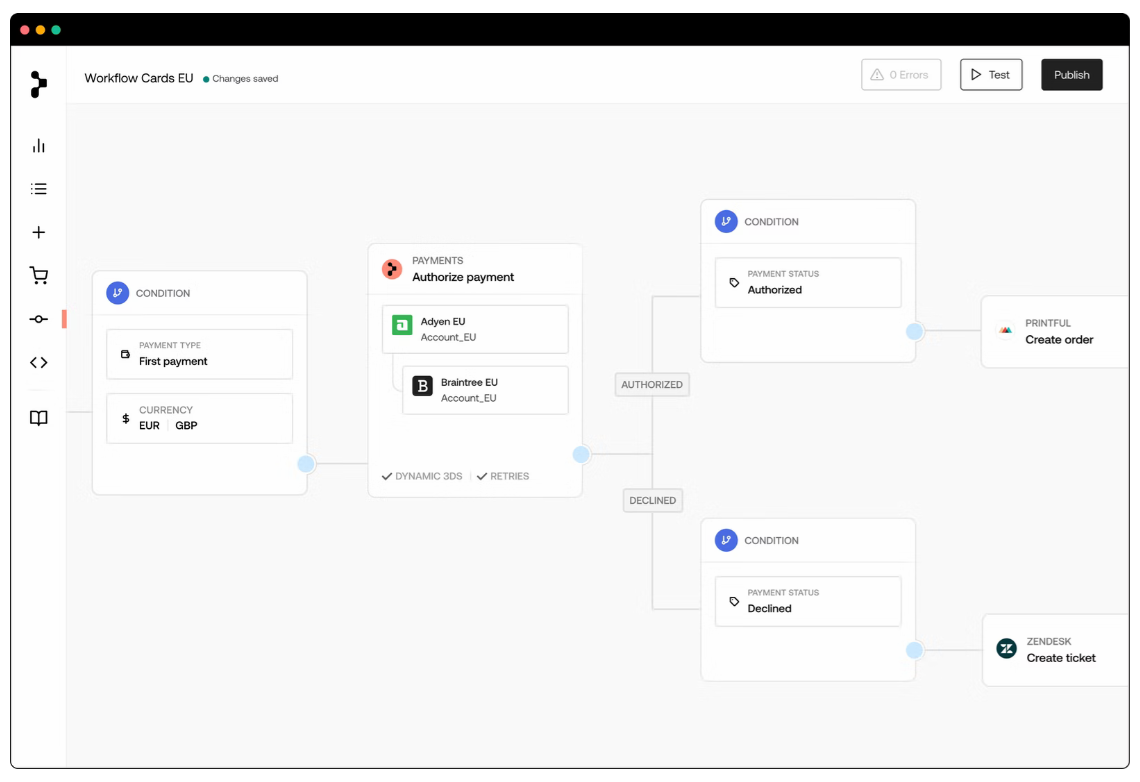

One of our portfolio companies, smol, illustrates this trend. As an online retailer selling eco-friendly homeware products direct to consumers, smol did not set out to deliver multiple payments solutions to its clients. Nonetheless, the needs of its clients push the company to offer and maintain a range of checkout and payment systems in multiple currencies and methods. There is, therefore, an increasing need for out-of-the-box solutions that reduce complexity. Primer, for example, offers a no-code solution that gives merchants the ability to build, connect and control their entire payments workflow and quickly connect to Stripe, Klarna, GoCardless and other providers. This allows companies like smol to focus on core business, without requiring a large team of payment specialists.

Primer helps organisations to create powerful flows and improve payment success without code

Revenue streams

As the payment sector evolves, one school of thought is that the variable cost of payments should trend to zero and become free. While this goal has been an aspiration for more than 30 years, in reality, it is still nowhere near true. High-cost payments from providers like Klarna or Bolt in the US are growing quickly because they offer the convenience consumers value. Convenience leads to client conversions so merchants like Klarna-style payments too. They need customers to find easy ways to pay and maximize conversion. If that costs them 2%, they will happily pay that. There will always be value in the stack if it helps to drive conversion.

Businesses also need a robust architecture that can deal with payments as well as chargebacks, credit risk on some payment methods and other edge cases. There is a cost for this. Even if the movement of the payment was free, there is work needed before and after the actual transfer. Take the example of fraud. There is a need to provide KYC and other checks which often use data from a third-party source and therefore have a cost. Providers will always have to charge a meaningful amount for payments. They will undoubtedly become cheaper. But payments will not go to zero.

New Markets

As we look to the year ahead, there are several areas we think are particularly exciting. The first is services that convert fiat to and from crypto. These two worlds were once a long way apart, with very clunky on-ramps to crypto, bad interfaces and long lags when changing fiat into crypto or vice versa. Native crypto wallets offered easier access to the crypto markets and the experience of using exchanges has become ever more regulated and user-friendly. Today, these wallets aren’t even necessary. Ramp, one of our recent investments, allows users to acquire the digital assets they need inside of the application they already have open, using their preferred credit card. This makes buying digital assets as straightforward as buying USD when making a purchase from your favourite American brand in Euros.

We’ve gone from two worlds which were very hard to link – to one where you no longer need a wallet to invest in crypto.

It has often been difficult to take crypto from inside an application environment and get it back out to card, because of fraud issues and KYC. The next innovation will make this off-ramp as seamless as the on-ramp. We’ve gone from two separate worlds which were very hard to link to a new world where you can invest in crypto without needing a wallet. The second is direct B2B payments that mirror C2C payments. We are seeing more B2B marketplaces with online checkouts that resemble e-commerce sites and allow card payments. There is a company called Melio in the US that allows businesses to pay invoices by card and it is now huge. Companies are beginning to use Open Banking for payments and we are seeing a lot of players offering a Klarna-style BNPL invoice financing to businesses. In Germany, Billie is already offering BNPL services for businesses. We expect a lot of growth in this space and think it is very likely that a B2B payments founder will start a company that becomes as big as Klarna.

Startups that improve payment flows in specific industries such as medical and education are also likely to win during the evolution of Payment 3.0. Balderton previously invested in Flywire, a global payments enablement and software company that specialises in delivering complex payments for clients. It has led the way in upgrading payments in education, insurance and healthcare in the US and Europe. There are big businesses to be built that facilitate payments analogue consumer-facing businesses.

Companies that allow modern payments infrastructure to be built on top of legacy systems are likely to flourish in the coming years. Numeral, a Balderton portfolio company, automates payments across banks with an API and works with legacy banking standards for payments. It is answering the question of how to make decades-old payment methods feel like API-driven interfaces for modern businesses. We expect to see other founders start big companies that allow old systems to interact with new technology.

European Innovation

Innovation is taking place across the world, but we unequivocally believe that Europe will lead the payments market, whether that be B2B, C2C or account-to-account. The frequency and complexity of multi-currency payments have always been greater in the region than anywhere else. We would also argue that a lot of the innovation in Payments 1.0 and Payments 2.0 came from Europe. Payments in Europe are substantially cheaper and faster than in the US, and they will continue to be so.

Given it is the leading centre of payments and FX markets and has the most complex challenges, Europe will continue to lead the way in Payments 3.0. We look forward to meeting the founders who are creating the businesses which will be at the vanguard of this next wave.