- Portfolio News

- 17 December, 2024

Goldman Sachs joins the growing list of investors, including Balderton, the Ontario Teachers’ Pension Plan Board, Index Ventures.

ComplyAdvantage is the financial industry’s leading source of AI-driven financial crime risk data and detection technology. The company’s mission is to neutralise the risk of money laundering, terrorist financing, corruption, and other financial crime. Balderton first invested in ComplyAdvantage in 2016, leading the company’s Series A. This latest investment is an extension to the company’s oversubscribed Series C funding announced in July 2020. ComplyAdvantage will use this new investment to build on the rapid growth it has experienced to date and cement its position as a critical part of the value chain for companies managing evolving risks around anti-money laundering (AML), know your customer (KYC) processes and broader financial crime.

We first invested in Charlie and the rest of the team at ComplyAdvantage for their fierce focus on solving a regulation technology challenge that was hitting financial service disrupters, including many in our own portfolio. Over five years later, the team and business are at least two orders of magnitude larger but the mission is the same only that, as this investment round demonstrates, it’s now a critical problem for everyone in the financial service industry, including the biggest and smartest names in the business.

Suranga Chandratillake Partner, Balderton

Related video

Suranga talks to Founder & CEO Charlie Delingpole of ComplyAdvantage at the Balderon Collective CEO Retreat, May 2018.

Charles Delingpole, CEO, ComplyAdvantage

Financial services innovation is the catalyst for massive business transformation. Companies need a hyper-scale AML and risk solution as a financial crime deterrent. Goldman Sachs is a great partner for ComplyAdvantage because they recognize the power of intelligent AML and risk detection not only to fortify businesses but also to help them introduce new services to market with greater confidence and integrity.

Financial services innovation is the catalyst for massive business transformation. Companies need a hyper-scale AML and risk solution as a financial crime deterrent. Goldman Sachs is a great partner for ComplyAdvantage because they recognize the power of intelligent AML and risk detection not only to fortify businesses but also to help them introduce new services to market with greater confidence and integrity.

Charles Delingpole, founder and CEO of ComplyAdvantage

Due to the unprecedented acceleration of digital transformation, rapidly growing fintechs and corporates alike need a partner that can keep pace with innovation and market opportunities in the compliance space. Given the growing volume, velocity and complexity of financial crimes, the traditional methods of human analysts reviewing batched data are no longer viable in many cases.Instead, what’s needed is an intelligent approach to AML and risk mitigation using massive amounts of data that’s contextualized with machine learning logic to deliver insights with greater accuracy in real-time and at scale.ComplyAdvantage’s hyper-scale AML and risk detection technology does exactly that, so the data never grows stale. Companies future proof their risk management solution and can grow with confidence.

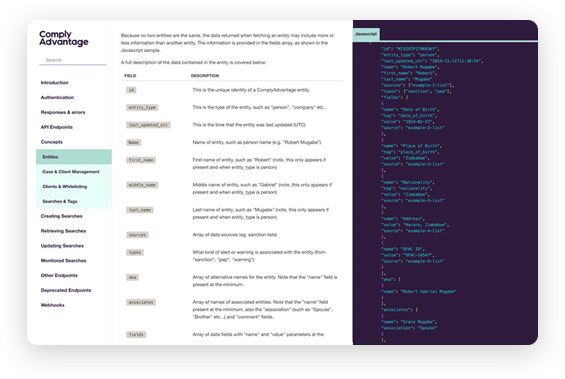

ComplyAdvantage allows customers to easily integrate its AML data with preexisting workflows using its industry-leading APIs.

ComplyAdvantage offers a true hyperscale financial risk insight and AML data solution that leverages machine learning and natural language processing to help regulated organizations manage their risk obligations and prevent financial crime.The company’s proprietary database is derived from millions of data points that provide dynamic, real-time insights across sanctions, watchlists, politically exposed persons, and negative news. This reduces dependence on manual review processes and legacy databases by up to 80% and improves how companies screen and monitor clients and transactions